HYBRID-CREATORS

Hybrid Creators Launches a New Era with Jean Diaz, the World’s First Hybrid Actor

Where human sensitivity meets machine potential – Unite Hybrid AI Actors, Filmmakers and Investors

Watch full Trailer

Making history by the first Hybrid actor ever

As AI continues to shape global media and cultural conversation, Hybrid Creators represents Hybrid Performers across film, music, and television through licensed likeness—without requiring creators to be physically on location. All hybrid performances are created with full creator consent and under clearly defined agreements worldwide, ensuring an ethical and artistically driven use of AI.

The future of live-action cinema will be hybrid

Shaped by AI, but driven by people, our hybrid Creators will also headline a planned slate of future hybrid-actor films & micro series becoming the first hybrid stars in live-action cinema history.

We are introducing a new hybrid category in music and cinema worldwide.

- On location the performance of a trained human

- Combined with the licensed Hybrid likeness of a creator

The Concept

We produce and also acquire globally appealing indie films, enhanced by Hybrid AI actors, AI-driven re-edits, dubbing, and viral marketing. Unified under one brand, we’re building the largest hybrid AI actors and IP revenue-sharing platform — and paving the way for the first fully AI-generated live-action films.

Trilogy of AI-enhanced feature films

Unified under one brand, also saving costs by AI, we (re)launch indie films worldwide.

Community-powered

Building the largest IP revenue-sharing platform for globally distributed films.

Largest IP platform

Funding film makers with strong global stories.

Revenue sharing

Profits distributed annually to our token holders.

Unlock human talent by AI: the hybrid future of film

First Security Token Offering (STO)

Security Token Offering (STO) with annual profit distributions.

The hybrid future of film

Films powered by AI and IP on blockchain

Token Appreciation

Real World Asset

Exposure to IP-backed media asset

Proof of Story

Full script & independent book

Strong IP foundation

Pipeline & Growth Strategy

Rather than relying on single-title success, we have pre-produced five original trilogies and will select an additional fifteen independent films — thirty films in total — each designed to cultivate global audience loyalty and long-term franchise value;

2026 Q2

RebelDogs I Release

2026 Q4

RebelDogs II + 5 Indie Films

2027 Q4

RebelDogs III + 5 Indie Films

2027+

Expansion into 5 trilogies (15 films), spin-offs & streaming platform + 5 Indie Films

FOR U.S. Accredited anD EU Qualified Investors only

Key Milestones

Why Invest in Rebeldogs AI Now

3× Smarter, 3× Cheaper

First Film Complete & Debt-Free

Early Investor Advantage

Limited allocation before valuation steps up.

Partnership Model

We partner with talented filmmakers by:

- Offering equity swaps or token-based financing

- Covering part of production or marketing budgets

- Integrating their films into our global IP library

Our goal is to build the largest decentralized film IP library, giving filmmakers global exposure, shared profits, and ongoing digital life for their projects by Hybrid actors.

First-Mover Advantage

The world’s first AI-native film studio, positioning as a category leader.

Risk-Adjusted Entry

Initial feature film already completed and distributed; investors step in with execution risk substantially reduced.

Governance & Control

Delaware legal framework, structured shareholder protections, and codified dividend policy.

Liquidity Path

Post lock-up, securities are transferable through DigiShares’ regulated secondary market, providing a potential path to liquidity.

Scalability

Multi-film pipeline ensures repeatability, compounding revenues, and franchise-style upside.

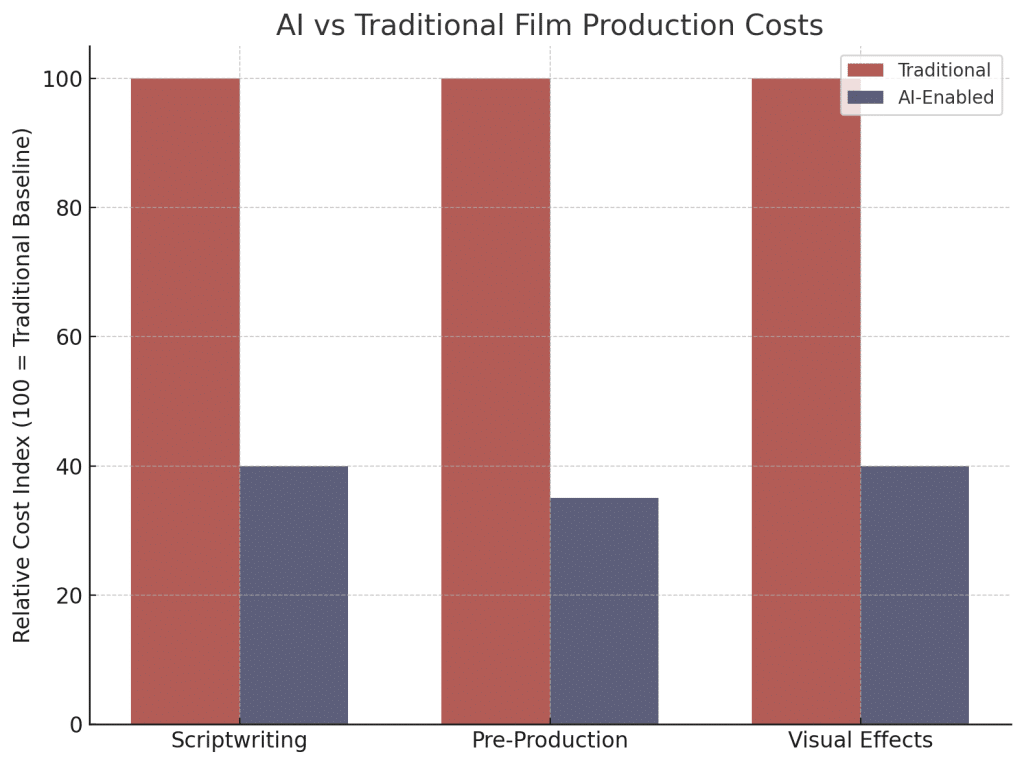

AI Slashes Film Production Costs

By embedding AI into scriptwriting, pre-production, and VFX pipelines, Rebeldogs AI reduces costs by 60% or more across the most resource-heavy stages of filmmaking — while maintaining cinematic quality.

FOR U.S. Accredited anD EU Qualified Investors only

Institutional Structure & Governance

Haege Groep B.V. (Netherlands)

IP holding entity retaining all rights and revenues.

Budget Management S.L. (Spain)

Production entity with a fixed 10% fee, ensuring cost discipline and delivery.

Rebeldogs AI Studio Inc. (Delaware, USA)

Fundraising vehicle enabling SEC-compliant U.S. capital raising under Reg D 506(c).

Governance

All securities are issued and managed via the DigiShares platform, providing digital cap table management, KYC/AML compliance, and regulated secondary transferability post lock-up.

Finance Executive Leading the Numbers

Leadership & Advisors

Morgan Grunefeld

FOR U.S. Accredited anD EU Qualified Investors only

Leadership & Advisors

Rebeldogs AI is building more than films — it is building an AI-powered studio model designed for institutional capital. With proof of execution, structured governance, and a scalable franchise pipeline, this offering provides a rare opportunity to participate at the foundation stage of a category-defining enterprise. With proof of execution, structured governance, and a scalable franchise pipeline, this offering provides a rare opportunity to participate at the foundation stage of a category-defining enterprise.

Unlock human talent by AI: the hybrid future of film

FAQ

This private placement is worldwide but in the U.S. for accredited investors under U.S. Regulation D, Rule 506(c). All investors must complete KYC/AML verification through the DigiShares platform before subscribing.

Investors receive digital securities (security tokens) issued by Rebeldogs AI Studio Inc. (Delaware C-Corp). These represent equity interests in the company and are recorded on the DigiShares platform.

Yes. Securities issued in this private round are subject to a 12-month lock-up period. After the lock-up expires, transfers may only be conducted through DigiShares’ regulated secondary market, subject to compliance checks.

Based on the company’s valuation methodology and discounted entry pricing, investors benefit from both profit participation and potential capital appreciation across the 30 -film pipeline.

Profits flow as follows: (i) production costs and fees to Budget Management S.L., (ii) 10% IP royalty to Haege Groep B.V., (iii) applicable taxes, and (iv) pro-rata distributions to shareholders in line with the Delaware Shareholders’ Agreement.

1. Secondary market transfers post lock-up on DigiShares.

2. Strategic sale or merger of the studio or its IP portfolio.

3. Public STO round post-Rebeldogs 1 release, expected at a higher valuation.

100% of proceeds from this $5 Million raise are allocated to the production of Rebeldogs 2 and 3, both already in pre-production.

Shareholders benefit from institutional safeguards including:

• Dividend policy codified in Delaware law.

• Tag-along and drag-along rights.

• Structured lock-up and transfer restrictions.

• Independent production agreements to control costs.